To view a video of this content, click here

What do I do if I lose my health insurance?

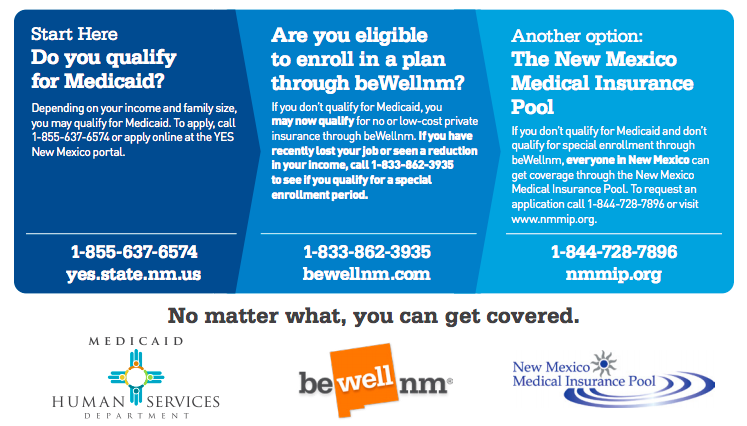

Coronavirus is a public health emergency that has upended the economy, causing tens of thousands of New Mexicans to lose their jobs and the health insurance provided by their employer. No one should go without health coverage during this pandemic. Fortunately, there are quality coverage options available to all people in New Mexico. Most people who lose their insurance qualify for Medicaid or Marketplace coverage. If you don’t qualify for those options, you automatically qualify for comprehensive coverage on the New Mexico Medical Insurance Pool. It is important to sign up as soon as possible to avoid disruptions in coverage and meet the deadline for getting covered. Here is Health Action NM’s guide to staying covered and avoiding scams during this difficult time.

What do I qualify for?

Everyone qualifies for coverage during the pandemic. The first thing you should do is use Healthcare.gov’s online screening tool to see what type of coverage you might qualify for. Based on that screening, we recommend contacting the New Mexico Human Services Department, BeWellnm, or the NM Medical Insurance Pool to get help filling out your application. But if you want to sign up on your own, this blog post has some helpful tips.

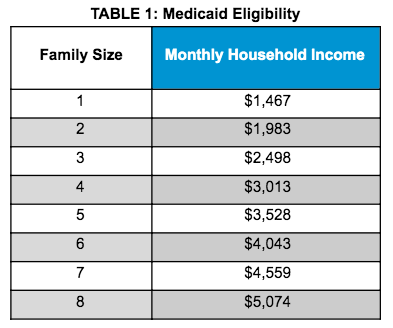

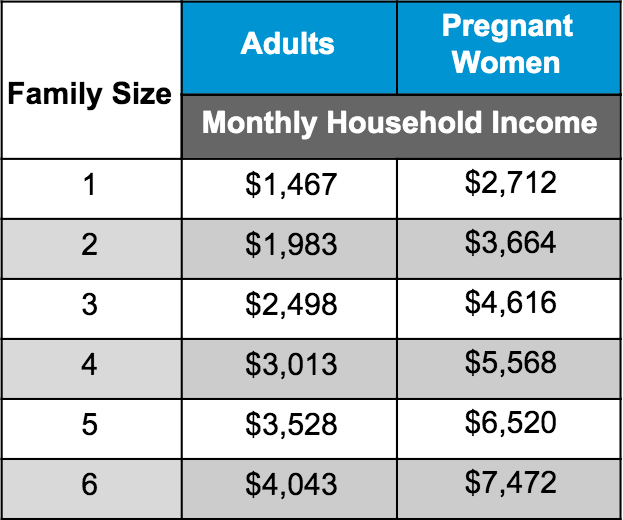

Medicaid

Medicaid is a comprehensive health coverage program that is available to low-income U.S. citizens. If you receive coverage through Medicaid, all costs related to COVID-19 will be covered free of charge. If you were billed for testing or treatment related to COVID-19, you can file a complaint here. Medicaid eligibility is based on your household’s current monthly income, not how much you made in the past or expect to make this year. You qualify for Medicaid if you make less than the monthly income listed on the table below called “TABLE 1: Medicaid Eligibility.” When selecting your family size, include yourself, your spouse, and everyone you claim as a dependent, even if they don’t need coverage. If you have questions about whether or not to include someone when determining your family size, check here.

To see if you qualify for Medicaid, select how many people are in your family at the far left of the table, then see if your monthly income is below the amount listed. If it is, you likely qualify for Medicaid. Even if you don’t qualify for Medicaid, your children might.

If you think you qualify for Medicaid, here is how you can sign up. We recommend starting off by calling the Human Services Department at 1-855-637-6574 to confirm that you meet the basic program requirements.

Sign up over the phone: If you want help with your application call or prefer to complete your application over the phone, call 1-855-637-6574.

Sign up online:Online Application

Fill out the application on paper:Paper Application

Need help? Call customer service at 1-800-283-4465 or visit this webpage.

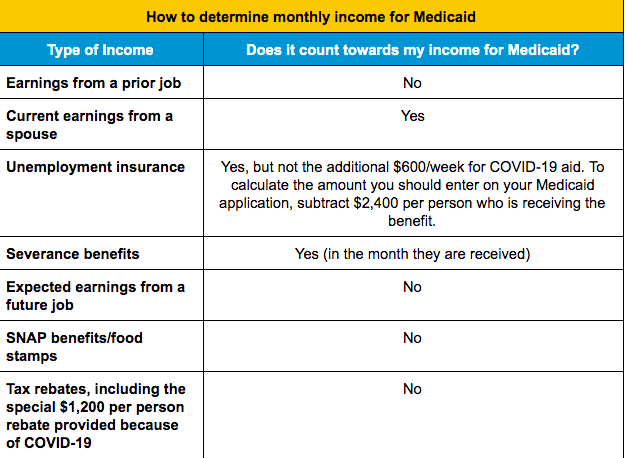

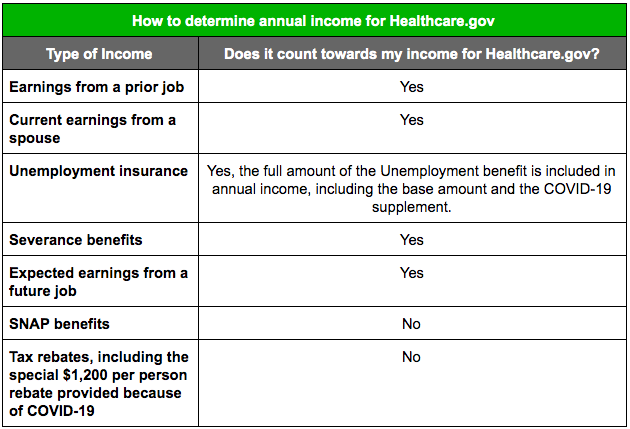

During the application process, you will be asked to provide information about your household income. The table below shows the type of income information that you will need to share to get covered.

Source: Brookings Institute

Marketplace Coverage through BeWellNM

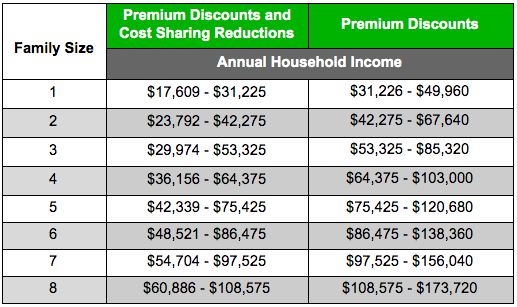

Marketplace Coverage is available to individuals and families that do not qualify for Medicaid and are not offered insurance by an employer. COVID-19 testing and treatment is covered free of charge, thanks to an order signed by the New Mexico Superintendent of Insurance under Governor Lujan Grisham’s COVID-19 emergency order. Many Marketplace applicants qualify for premium reductions based on income and household size. These reductions are called Premium Tax Credits, and are based on your expected incomefor the year you are applying for coverage. For instance, if you were enrolling for coverage for 2021, you would calculate what you think your income will be for 2021, and the Marketplace will use that amount and your household size to calculate the discounts you qualify for. For questions about how to estimate your income and who to include in your household, click here.

If you lose your job-based health insurance, have a significant reduction in your income, or experience other qualifying events, you may be eligible for a special enrollment period to sign up for coverage. If you experience one of these events, you have a 60-day window to apply for coverage.

Remember, if your income goes up during the year, you should adjust it on Healthcare.gov so that you don’t have to pay it back at the end of the year. You can also adjust your income down if you expect to earn less, which will reduce your premiums. If you gain a new form of coverage, such as Medicaid or job-based coverage, make sure to terminate your coverage through BeWellNM to avoid unexpected fees.

If you think you qualify for Marketplace Coverage through BeWellNM, here is how you can sign up. We recommend starting off by calling BeWellNM (New Mexico’s Health Insurance Exchange) at 1-833-862-3935 to confirm that you meet the basic program requirements.

Sign up over the phone: If you want help with your application call or prefer to complete your application over the phone, call 1-833-862-3935.

Sign up online:Online Application

Fill out the application on paper:Paper Application

Helpful resources:

Get more helpful information:bewellnm.com

Use the NM Plan Comparison Tool:New Mexico Plan Comparison Tool 2020

Preview your options:Window Shop for a Plan

During the application process, you will be asked to provide information about your household income. The table below shows the type of income information that you will need to share to get covered.

The New Mexico Medical Insurance Pool

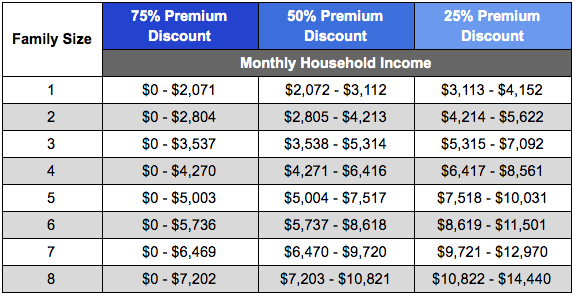

All people who reside in New Mexico qualify for the New Mexico Medical Insurance Pool (or “the pool”). COVID-19 testing and treatment is covered free of charge. You can sign up for the pool any time of the year. You can get premium discounts based on your income.

Normally, the pool uses your tax return from the previous year as well as any Social Security payments you receive to determine eligibility. However, if you lose your job or have other major changes in your economic situation, you can give them an estimate of your current income and the pool will work with you to reduce your premiums.

If you think you qualify for the New Mexico Medical Insurance Pool, here is how you can sign up. We recommend starting off by calling the pool at 1-505-424-7105 or 1-844-728-7896 to confirm that you meet the basic program requirements.

If you want help with your application call or prefer to complete your application over the phone, call 1-505-424-7105 or 1-844-728-7896.

Fill out a digital or paper application:Digital or Print Application

Keep your employer coverage

COBRA allows you to continue the health coverage you had through your employer after you lose a job, as long as the termination did not involve gross misconduct. This option is available to workers whose employer covers 20 or more employees. COBRA is usually quite expensive and other coverage options, like Medicaid, Marketplace Coverage through BeWellNM, and the NM Medical Insurance Pool, are typically more affordable. Click here to see if you qualify for COBRA. For application assistance, call 1-866-444-3272. If you need more information, you can visit the following websites:

#Q1">NM COBRA FAQ

New Mexico COBRA Insurance - Health Care Continuation

U.S. Department of Labor: Continuation of Health Coverage (COBRA)

How can I get help with my application?

If you want to talk to an enrollment counselor who is not affiliated with any health insurance company, visit https://bewellnm.com/Find-Counselor. They can usually help you sign up for any type of insurance, including Medicaid, Marketplace Coverage through BeWellNM, the NM Medical Insurance Pool, or Medicare.

If you want to talk to a broker about signing up for private insurance or insurance through the NM Medical Insurance Pool, visit https://bewellnm.com/Find-Broker to find a broker in your area.

Medicaid

Human Service Department’s Customer Assistance Center: 1-800-283-4465

Marketplace Coverage through BeWellNM

BeWellNM’s Call Center: 1-833-862-3935

NM Medical Insurance Pool

Office Number: 1-505-424-7105

Call Center: 1-844-728-7896

How do I avoid scams?

Unfortunately, some are using this pandemic as an opportunity to sell junk health insurance by misleading people about their options. Here are some websites you can trust to give you accurate information about comprehensive health coverage:

Hsd.state.nm.us or yes.state.nm.us

Health Action