by Colin Baillio

Adam Consiglio is fighting for consumers whose prescription medication coverage lapses mid-year.

Adam Consiglio is a businessman in Taos, NM. He’s worked in the mortgage industry for decades and even lobbied on the industry’s behalf at the State Capitol. But now, he’s coming to the roundhouse every day to fight for a different constituency: patients.

Last year, Consiglio was informed that his prescription medication was being dropped from his health plan in the middle of the year. “I spent hours researching all of the different forms of this particular medication, consulted my doctor, and finally found one that wouldn’t give me unwanted side effects,” Consiglio explains. A few months later, he was informed that his doctor was being dropped from his plan, too. “I specifically purchased that plan so that I could get that medication and see my doctor. And now, in the middle of the year, I’m suddenly cut off? It was not right…I expected to get what I paid for.”

When he called two other health insurance companies to find a 2017 plan that covered his medication, neither could give him an answer. “Their formulary [a list of drugs that a plan will cover] wasn’t set! How am I supposed to make an informed decision if they can’t even tell me what’s offered?” Consiglio had enough. He called his state representative to explain what had happened and ask what could be done about it. “Look, I can afford it, so I just paid for it out-of-pocket. But I started thinking about all the people who aren’t as fortunate .”

The answer seems clear: when a consumer signs up for a health plan, they should know what they are getting. Insurance companies shouldn’t be able to restrict access to prescription medications or health care providers in the middle of the year. The contract between the consumer and the insurer should be upheld for the duration of the plan. If new drugs are introduced at a lower price, the insurance carrier can share the savings with the consumer by offering lower out-of-pocket costs to switch the new drug. As with all things in the U.S. healthcare system, the interested stakeholders said answer was not so simple.

An inadequate compromise

This issue was debated in New Mexico as recently as 2013, when a bill was introduced to end mid-year formulary restrictions for certain health plans. The industry backlash was fierce. Insurance companies and pharmacy benefit managers (middlemen that negotiate prices with pharmaceutical manufacturers on behalf of insurance companies) argued that it would drive up premiums and give drug manufacturers an advantage in negotiations.

A compromise was reached, requiring insurance companies to inform consumers of any changes to prescription medication coverage within 60 days of the change and limiting changes to every 120 days. These are the types of restrictions that can be made in the middle of a plan year:

- Reclassifying the drug to a higher tier of the formulary;

- Reclassifying a drug from a preferred classification to a non-preferred classification unless it is to a lower tier of the formulary;

- Increasing the cost-sharing, co payment, deductible or co-insurance charges for a drug;

- Removing a drug from the formulary;

- Establishing a prior authorization requirement;

- Imposing or modifying a drug’s quantity limit; or

- Imposing a step therapy restriction.

But the law doesn’t appear to be adequately enforced. Barbara Webber, Executive Director of Health Action New Mexico, was moved off three of her four medications without warning last year (Disclosure: Barbara is also the author’s boss). “I struggled to navigate my way through the system and I have been working in health care and health policy for decades,” Webber said during her testimony to the New Mexico House Health and Human Services Committee. “I spent upwards of forty hours filing appeals, explaining my doctor’s orders to insurance representatives and pharmacies, tracking medication authorizations and reauthorizations. I was forced to go without needed medications for weeks or months until the issue was resolved. Not everyone has the knowledge and time to commit to this kind of hassle. And frankly, they shouldn’t have to.”

Even if Barbara was informed within the 60-day time period required by law, she still would have been left to navigate the system on her own, forced to switch her medication or pay more out-of-pocket despite her original agreement with the health insurance company when she purchased the plan.

The big picture

Insurance companies aren’t restricting access to medications just because they want to save money for themselves (thought that is a factor). They are responding the skyrocketing prices of prescription medications that go up throughout the year. The rise in prescription drug costs is out of control. A report found that pharmaceutical costs have increased an average of 8.3% per year since 1994, far beyond the rate of inflation. In recent years, we have seen more dramatic price increases and the introduction of expensive specialty medications.

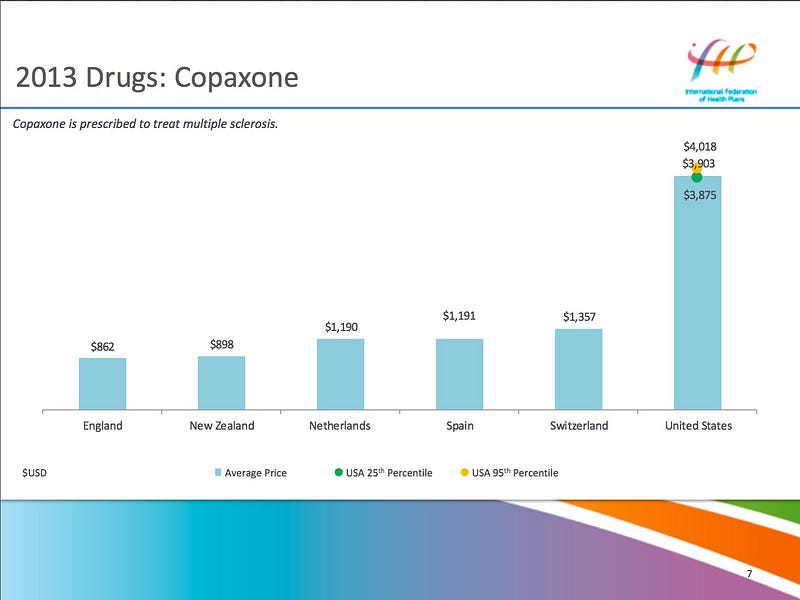

Even generic medications (which are generally less-expensive forms of brand name medications) are seeing explosive increases. A recent study found that “almost 400 generics saw price increases of more than 1,000%” between 2008–2015. And the U.S., by design, pays far more than any other country for nearly every medication. For example, take a look at the cost of a prescription medication called Capaxone in 2013.

Source: International Federation of Health Plans

At the same time, when restrictive measures are placed on life-saving medications, people respond by splitting their pills in half to make the prescription last longer, cutting down on other expenses like food, or not taking medications as directed. This leads to a variety of negative outcomes, including higher death rates, worse health status, more hospitalizations, and increased costs to the system. The measures allowable under current health insurance law do very little to protect consumers from these risks.

Louisiana (yes, Louisiana) is ahead of the curve on this issue

In 2011, Louisiana, one of the most conservative states in the nation, successfully tackled this problem. Louisiana’s law requires insurance companies to provide a guaranteed formulary once the plan is available for purchase and disallows efforts to restrict access to medications. Insurers can always add medications to the formulary and the only restrictive change that can be made is moving a medication to a higher cost sharing level if a generic medication becomes available.

Did the law lead to an explosion of premiums? Quite the opposite. A 2016 study found that “Louisiana experienced the largest slowdown [in single premium growth rates in the employer market], as average premium growth fell from 7.8 percent a year between 2006 and 2010 to 2.4 percent from 2010 to 2015.” At the same time, deductibles in Louisiana rose 3.1% between 2010 and 2015, the fourth-lowest rate in the nation.

Source: Commonwealth Fund, 2016 (click link for interactive map)

Why did premiums and deductibles rise at a much lower rate than the national average when the 2011 law insurance companies said would lead to higher costs? Part of the explanation could be that, thanks to the 2011 law, patients have better adherence to doctor’s instructions because their access to medications isn’t unexpectedly prohibited by increased costs, leading to reduced health risks and lower use of other health care services. This theory needs to be studied more closely, but the data show that the law did not lead to the kind of premium and deductible growth that critics feared.

Take action

Mr. Consiglio plans to keep fighting to protect consumers from these harmful practices. “In the mortgage, even minor changes to the terms of the loan during the application process need to be disclosed to, and acknowledged by, the consumer, We are dealing with our health care here which I believe is more important.” You can take action to advance this bill during the legislatives session.

- If you have been impacted by this issue, please click here to share your story.

- You can track HB 112 and the companion SB 291 by clicking the hyperlinks.

- Contact members of the House Health and Human Services Committee and Senate Public Affairs Committee to voice support for the legislation.

- When it passes House Health, the bill moves to House Judiciary. When it passes the Senate Pubic Affairs Committee, the bill moves to Senate Judiciary.

- And of course, the bill will need to pass both chambers and be signed by the governor. Click here to find your local Representative and Senator and write them a letter, call them, or meet with them in person to urge them to support the bill. If you’ve never done this before and want some tips, check out this simple guide.

- When the bill reaches Governor Martinez’s desk, you can contact her office by calling (505) 476–2200.

A reflection of the broader problem

While disruptions in prescription medication coverage are significant issues faced by consumers, they are symptomatic of a larger problem in the U.S. Our health care system is organized around a poorly coordinated network of doctors, hospitals and clinics, drug manufacturers, health insurance companies, pharmacy benefit managers, and various other players. Many of these stakeholders exist in other countries, but are organized to minimize the burden on the most important person in the system: the patient.

Laws that make it easier for patients to get the care they need without disruption are badly needed if we hope to make our healthcare system achieve the goal of a healthier population. We should do everything in our power to ensure that the various interests in U.S. health care are serving the patient, first and foremost. That means supporting legislation like HB 112 and SB 291 as well as laws that would rein in pharmaceutical companies on prescription drug prices.

— — —

Colin Baillio is the Director of Policy and Communications at Health Action New Mexico, a non-profit, statewide, health consumer advocacy organization that works to ensure that all New Mexico communities have access to quality, affordable, medical and dental care. Health Action New Mexico has extensively researched and officially endorsed HB 112 and SB 291.

Health Action