As early as this Monday, the Supreme Court is expected to issue a ruling on a case that would strip health insurance subsidies from 6.4 million people. The plaintiffs in the case, which is called King v Burwell, claim that Congress intended to withhold subsidies from states that chose not to establish a state-based health insurance exchange. Though the history of the Affordable Care Act’s (ACA) passage suggests that this was never the case, there are signs that the Supreme Court may indeed strip subsidies from states with federally facilitated marketplaces.

Consumers in New Mexico are protected from a bad decision since our state operates a state-based exchange, but it has the potential to negatively affect New Mexico in a number of ways, depending on how Congress handles the fallout of the decision. President Obama has called on Congress to simply fix the language in the ACA to clarify that the subsidies are available to all states. However, congressional Republicans are seeking to extract concessions in exchange for a continuation of subsidies. Instead of re-capping the news of the week, Health Action NM has thoroughly investigated the concessions being called for by congressional Republicans and the implications that they have for consumers.

Repeal the Individual Mandate

The Individual Mandate, which requires all Americans to acquire health coverage or else pay a penalty, has long been a target for repeal since it is the most unpopular part of the ACA. However, it is the glue that holds the rest of the law together, including the popular components such as a ban on denying insurance based on pre-existing conditions, guaranteeing that consumers can purchase any coverage that they want, and ending the practice of charging women more than men for insurance.

Without the individual mandate, the incentive to purchase insurance would be greatly weakened, creating a dysfunctional market in which only the sickest consumers sign up for coverage. This would cause premiums to soar, causing more consumers to drop out of the market, leading to what economists call a death spiral. The nonpartisan Center for Budget and Policy Priorities estimates that 22 million fewer uninsured people would be able to access insurance without the Individual Mandat

Repeal the Employer Mandate

The Employer Mandate requires all companies with 50 full-time employees or more to offer affordable health coverage to employees. According to the US Treasury Department, 96% of businesses in the US are exempt from the Employer Mandate because they have less than 50 employees. 96% of those that are required to offer coverage already do so and less than .2% of firms are expected face fines for not offering coverage.

The reason lawmakers included the Employer Mandate in the ACA was to ensure that companies didn’t drop their employee’s coverage and push them on to individual marketplace. A repeal of the provision has serious budgetary considerations as well. It would increase the amount spent on subsidies because more people would get coverage on exchanges that offer coverage. Still, it would not shake the ACA at its core the way a repeal of the Individual Mandate would.

Repeal the Medical Device Tax

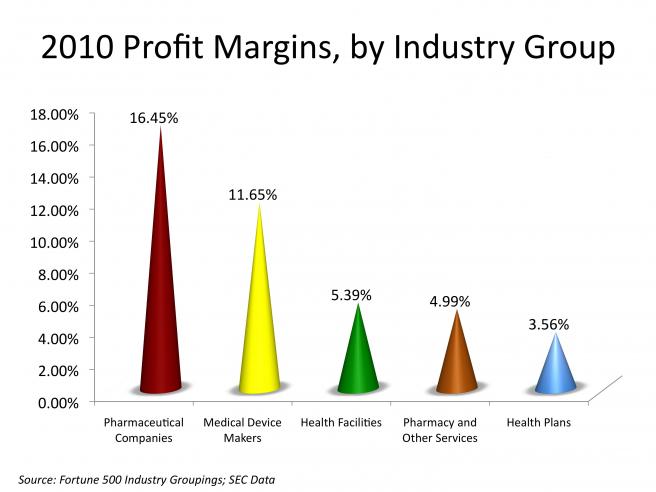

The Medical Device Tax applies a 2.3% tax on medical device manufacturers’ sales. The ACA is designed to reduce the deficit even as it expands coverage. To do that, lawmakers cut spending in some areas and increased revenues on industries that stood to benefit from the law. Since medical device manufacturers enjoy some of the greatest profit margins in the health care industry and stood to greatly benefit from increased utilization of their products as a result of the ACA’s coverage expansion, lawmakers included this tax as a way to finance the law.

Many have claimed that the tax gets passed on to consumers through increased prices, though Consumers Union (a consumer advocacy organization) disagrees, given the high profit margins and rate of growth that medical device manufacturers enjoy and the benefits it will reap from the ACA. Repealing the Medical Device tax would increase the deficit by $26 billion between 2015-2024, unless Congress could make up for the loss of revenue by increasing taxes or decreasing spending in other areas.

Repeal the Independent Payment Advisory Board

The Independent Payment Advisory Board (IPAB) is a committee of experts that would be convened if Medicare spending grew at an exorbitant rate. IPAB has not yet been convened because of the recent slowdown in health spending. If triggered, IPAB would be tasked with finding ways to restrain spending without impacting Medicare benefits. Congressional Republicans have long sought to repeal IPAB, claiming that it will lead to rationing of care, restrict Congress’ role in Medicare, and give bureaucrats too much control over patients.

However, the ACA specifically prohibits IPAB from rationing care, increasing premiums or cost sharing, cutting benefits, or limiting eligibility. Cost controls can only achieve savings through payment and delivery reforms. Congress will still play a central role in Medicare policy when IPAB is active. If Congress can produce equivalent savings, IPAB’s recommendations won’t go in to effect. It is likely to be the most effective cost containment program built in to the law and is vital to the sustainability of Medicare. Future generations need access to this important program for seniors and IPAB will play a critical role in ensuring the its integrity.

Repeal the Cadillac Tax

The Cadillac Tax refers to a 40% excise tax on health plans with unnecessarily excessive benefits. It is designed to discourage employers from offering benefits that drive up costs for everyone else and raise revenues to increase health coverage. Congressional Republicans claim that the tax limits employers’ ability to compete for employees on benefits and restricts access to the high quality health coverage.

In the 2008 presidential campaign, John McCain proposed ending the $250 billion a year tax break on employer sponsored health insurance to finance a new health care program. The Cadillac Tax achieves a similar result, only on a much smaller scale and on the upper echelon of high-end plans offered by employers.

Reduce Subsidies

Currently, those making under 400% of the Federal Poverty Level (FPL) are eligible for premium tax credits under the ACA. Some congressional Republicans have proposed that those subsidies be reduced, limited to those under 300% FPL, be based on age rather than income, and be a fixed dollar amount rather than based on the cost of insurance. This would seriously weaken the effect subsidies have on access to affordable insurance, especially for low and moderate income households. The way subsidies were initially designed was to ensure longterm affordability for individuals and families across the economic ladder. Reducing financial assistance just as so many have begun to feel the security of health coverage would be irresponsible and detrimental to consumers.

Health Action